Create trading signals

(for training a machinelearning (trading) model in the currency market)

Understanding the financial market (any instrument any exchange) must rank as one of the more challenging projects out there. The goal of this project remains to investigate if there is any identifiable structure in the market that may lead to a profitable trading strategy. By looking at the price movement of any market it is evident that there are some key moments when a new direction is taken, key moments where the dynamics of the price action has changed.

It is easy to think the aim of trading is to predict ‘the market’. Without understanding what a profitable trading opportunity is, we will be treating the market as a gambling house and loose, at the very least, a shirt.

In this script I pursue one way to identify a identify a trading opportunity. It will be in hindsight only! What good is that then you may ask? We are in the business of learning from the past and if it doesnt transfer to knowledge of the present then we need to question what we are here for. That is, I will look at times when I would have wanted to be long or short of a currency pair, and even more importantly, when I would have wanted to do nothing at all.

The idea below was my first approach, as time went on, I designed at least two more signal identifiers and I will explain them in later blogs. This script identifies the time to ‘enter’ the market and when to ‘exit’ it. Again with perfect hindsight. I have the following philosophy. In designing these trade signals I do not wish to be in the market and be left exposed to the volatility that is so inherent to it. The longer one is exposed to the market the longer the time window for new significant and market moving events. But I pefer nor to live in hope. The market is stochastic, but I prefer to minimize surprises. Hence as I will illustrate below, due to the nature of the market, by tweaking some risk parameters time ‘in’ the market is kept to a minimum.

Tick data as we collected in previous blogs, allow one to icoportate the cost of trading, at least to some degree. This is an important consideration since profit on a shorter less risky time window is also less, but trading cost is fixed. We always buy at the offer and always sell at the bid hence the cost of a complete trade is the spread or offer price - bid price. This idea presents its own risk. The spread is not something we control. Hence in time of low volume or high uncertainty we are at the mercy of the entity we trade with. More on that later.

The script here builds on the mongodb code previously used. Before we uploaded tick data. In this script we extract and search the database. This is why we created and index on the time field. We will search repeatedly on this field and the need for speed is compelling!

original_path=os.getcwd()

original_path="""/Users/christostrydom/Documents/github_repos/ae_mp/"""

working_path="""/Users/christostrydom/Data/"""

download_path="""/Users/christostrydom/Downloads/"""

chart_path="""/Users/christostrydom/Documents/github_repos/ae_mp/img/"""

client = MongoClient()

def get_opts():

# currency,stop_loss,profit_margin,strategy=get_opts()

return_dict={}

argv = sys.argv[1:]

try:

opts, args = getopt.getopt(argv, "c:l:p:s:i:")

except:

print("Error")

for opt, arg in opts:

if opt in ['-c']:

return_dict['currency'] = arg

elif opt in ['-l']:

return_dict['stop_loss'] = float(arg)

elif opt in ['-p']:

return_dict['profit_margin'] = float(arg)

elif opt in ['-s']:

return_dict['strategy'] = arg

elif opt in ['-i']:

return_dict['iterations'] = float(arg)

return return_dict

Function init_dict_fn looks in store_collection for the most recent tradesignal that exists for a set of strategy parameters. This sets the starting point for the iteration below. If there are no tradesignals for a particular set of parameters, the iteration will start at the start of the database and create an entirely new set of signals.

def init_dict_fn(collection, store_collection,strategy,currency,profit_margin,stop_loss):

init_list=list(store_collection.find({'currency':currency,

'profit_margin':profit_margin,

'strategy':strategy,

'stop_loss':stop_loss}).sort([('profit_time',-1)]).limit(1))

if init_list:

init_dict=init_list[0]

search_time=init_dict['profit_time']

search_price=init_dict['profit_price']

search_id=init_dict['profit_id']

else:

init_dict = list(collection.find({"gmt_time_py": {"$gt": datetime(1970, 11, 12, 12)}}).sort([('gmt_time_py',1)]).limit(1))[0]

search_time=init_dict['gmt_time_py']

search_price=init_dict['Ask']

search_id=init_dict['_id']

return search_time,search_price,search_id

Finding long trade signals:

Starting at the start_time, this function below looks forward in time towards the first time the ask price is lower than the start price MINUS a predefined stop loss value, that is, the first time a stop loss is triggered.

If a stoploss was triggered (and we know the time and price), find the first event before the time of the stoploss from above that would have triggered a profit-taking trade. For a long trade, that would mean an bid price above the start_price plus some value (the profit margin).

This scenario simply means that for a start price at some start time, there was a profit taking opportunity before a stop loss event. This is then a profitable long trading opportunity and includes the cost of trading by including the bid-ask spread.

def find_long_trade_fn(coll,start_time,start_price,profit_margin,stop_loss):

profit_dict={}

loss_dict={}

loss_list=list(coll.find({"gmt_time_py": {"$gt": start_time,

"$lt":search_time+timedelta(days=7)},

"Ask":{"$lt":start_price-stop_loss}}).sort([('gmt_time_py',1)]).limit(1))

if (not loss_list):

loss_list=list(coll.find({"gmt_time_py": {"$gt": start_time}}).sort([('gmt_time_py',-1)]).limit(1))

if loss_list:

loss_dict = loss_list[0]

loss_time = loss_dict['gmt_time_py']

profit_list = (list(coll.find({"gmt_time_py": {"$gt": start_time,

"$lt": loss_time},

"Bid":{"$gt":start_price+profit_margin}

}

).sort([('gmt_time_py',1)]).limit(1)))

if profit_list:

profit_dict=profit_list[0]

print('found a profit trade @ {start_time} ending at {ending_time}'.format(ending_time=profit_dict['gmt_time_py'],

start_time=start_time))

return loss_dict,profit_dict

Find a profitable short trade:

This function mimics the one above for long positions: starting at the start_time, this function looks forward in time towards the first time the bid price is higher than the start price PLUS a predefined stop loss value, that is, the first time we will trigger a stop loss.

If a stoploss was triggered, find the first event before the time of the stoploss trade above that would have triggered a profit-taking opportunity. For a short trade, that would mean an ask price below the start_price MINUS some value (the profit margin).

This scenario simply means that for a start price at some start time, there was a profit taking opportunity before a stop loss event. This is then a profitable short trading opportunity, and includes the cost of trading by including the spread.

def find_short_trade_fn(coll,start_time,start_price,profit_margin,stop_loss):

profit_dict={}

loss_dict={}

# Starting at the start_time look forward towards the first time the bid price is higher

# than the start price PLUS a stop loss value, that is the first time we will trigger

# a stoploss.

loss_list=list(coll.find({"gmt_time_py": {"$gt": start_time,

"$lt":search_time+timedelta(days=7)},

"Bid":{"$gt":start_price+stop_loss}}).sort([('gmt_time_py',1)]).limit(1))

if (not loss_list):

loss_list=list(coll.find({"gmt_time_py": {"$gt": start_time}}).sort([('gmt_time_py',-1)]).limit(1))

if loss_list:

loss_dict = loss_list[0]

loss_time = loss_dict['gmt_time_py']

# If a stoploss was triggered find the first event that would have triggered a

# profit taking opportunity. For a short trade that would mean and ask price below the

# start_price MINUS some value (the profit margin)

profit_list = (list(coll.find({"gmt_time_py": {"$gt": start_time,

"$lt": loss_time},

"Ask":{"$lt":start_price-profit_margin}

}

).sort([('gmt_time_py',1)]).limit(1)))

if profit_list:

profit_dict=profit_list[0]

print('found a profit trade @ {start_time} ending at {ending_time}'.format(ending_time=profit_dict['gmt_time_py'],

start_time=start_time))

return loss_dict,profit_dict

The script below iterates through the entire database for the currency defined by CURRENCY and notes all trading signals for long and short strategies. It saves the signals into its own tradingsignal collection from where it can once again be extracted for a machine learning exercise.

db=client.Currendcies

data_collection = db[CURRENCY]

# db.USDZAR_tradestore.drop()

signal_collection = db['{currency}_pmsl_tradestore'.format(currency=CURRENCY)]

signal_collection.create_index([ ("search_time", 1) ])

counter=0

store_dict={}

# search_time = datetime(2018, 11, 12, 12)

search_time,search_price,search_id=init_dict_fn(data_collection,

signal_collection,

STRATEGY,

CURRENCY,

PROFIT_MARGIN,

STOP_LOSS)

while counter < ITERATIONS:

counter+=1

if counter%10==0:

print(counter, search_time, search_price)#, CURRENCY,STOP_LOSS,PROFIT_MARGIN,STRATEGY)

if STRATEGY=='long':

loss_dict,profit_dict=find_long_trade_fn(data_collection,

search_time,

search_price,

PROFIT_MARGIN,

STOP_LOSS)

if bool(profit_dict)&bool(loss_dict):

store_dict['currency']=CURRENCY

store_dict['strategy'] = STRATEGY

store_dict['profit_margin'] = PROFIT_MARGIN

store_dict['stop_loss'] = STOP_LOSS

store_dict['search_time']=search_time

store_dict['search_price']=search_price

store_dict['search_id']=search_id

store_dict['profit_time']=profit_dict['gmt_time_py']

store_dict['profit_price']=profit_dict['Bid']

# store_dict['loss_price']=loss_price

store_dict['profit_id']=profit_dict['_id']

store_dict['_id'] = ObjectId()

store_dict['date_py']=datetime(year=search_time.year,

month=search_time.month,

day=search_time.day)

signal_collection.insert_one(store_dict)

search_price=profit_dict['Ask']

search_time=profit_dict['gmt_time_py']

if (not bool(profit_dict))&bool(loss_dict):

search_price=loss_dict['Ask']

search_time=loss_dict['gmt_time_py']

if STRATEGY=='short':

loss_dict,profit_dict=find_short_trade_fn(data_collection,

search_time,

search_price,

PROFIT_MARGIN,

STOP_LOSS)

if bool(profit_dict)&bool(loss_dict):

store_dict['currency']=CURRENCY

store_dict['strategy'] = STRATEGY

store_dict['profit_margin'] = PROFIT_MARGIN

store_dict['stop_loss'] = STOP_LOSS

store_dict['search_time']=search_time

store_dict['search_price']=search_price

store_dict['search_id']=search_id

store_dict['profit_time']=profit_dict['gmt_time_py']

store_dict['profit_price']=profit_dict['Ask']

# store_dict['loss_price']=loss_price

store_dict['profit_id']=profit_dict['_id']

store_dict['_id'] = ObjectId()

store_dict['date_py']=datetime(year=search_time.year,

month=search_time.month,

day=search_time.day)

signal_collection.insert_one(store_dict)

search_price=profit_dict['Bid']

search_time=profit_dict['gmt_time_py']

if (not bool(profit_dict))&bool(loss_dict):

search_price=loss_dict['Bid']

search_time=loss_dict['gmt_time_py']

# print(counter, search_time, search_price)

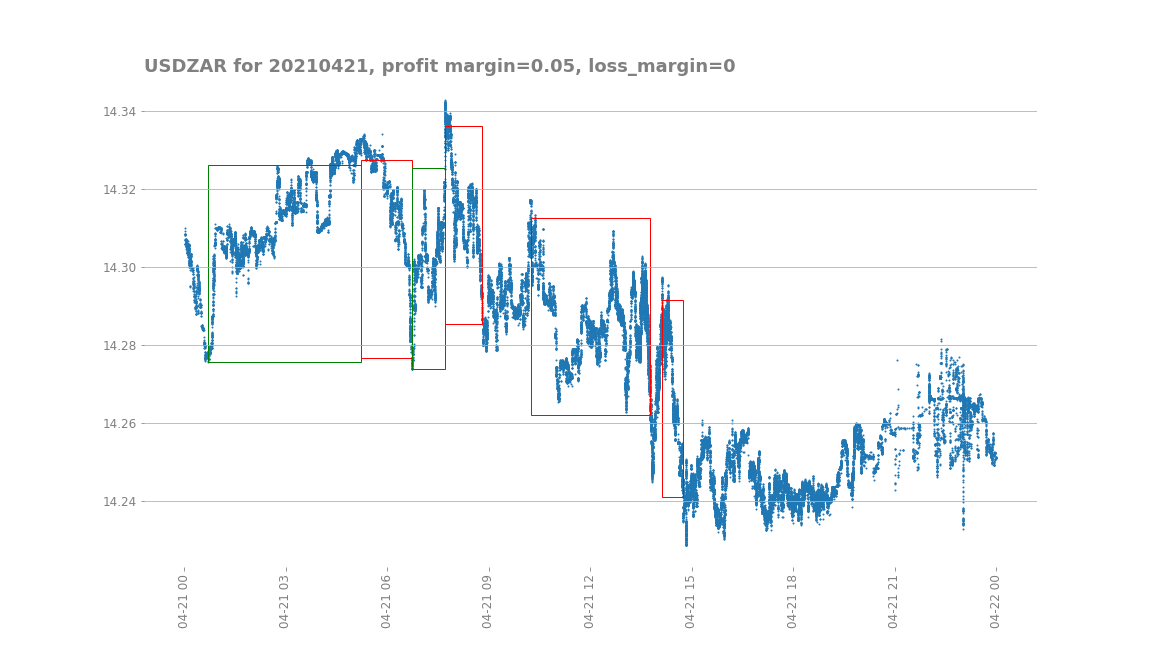

This is what the trading signals look like for 21 April 2021 for the USDZAR as an example, with a 5c profit target and a zero stop loss. The graph below was done on tick data and only the Ask price, hence it looks somewhat unfamiliar. But this way, we can see every single price recorded by this broker and we can simulate the real thing with some level of accuracy.

And that is it! Now there is a way of create trade signals given some expectation of profit together with a minimum stop loss to be tolerated. Notice that our take-profit value sometimes does not cover the entire range of a sizeable move and sometimes look too be too much for attractive opportunities. Ideally we want to cater for signals irrespective of some hard coded rule. More on that later.